Attention Busy Manufacturers!

Save Taxes

Legally Without Being Fearful Of

The Income Tax Department And Litigation

Discover tax-planning strategies that your Tax Consultant might be missing out on that can save you up to 8-10% on your effective tax rate, which can even be in CRORES

Hi! I am Dipanshu Mutreja

Tax Planning Expert-

5+

Years With Big 4 Firms

-

100+ Cr

Tax-Saved Collectively

-

40+

MNC Clients Served

Do you face the same challenges that 90% of the growing and big-shot manufacturers do?

Need Finance To Expand

Need Finance To Expand

Too Much Tax To Pay

Too Much Tax To Pay

Working Capital Is A Headache

Working Capital Is A Headache

Less Take-Home For owners

Less Take-Home For Business owners

If yes, your current tax planning is actually costing you money!

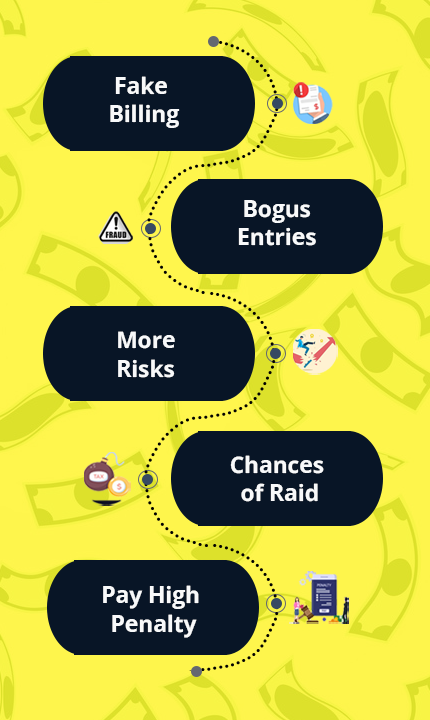

The truth is: There is a difference between efficient tax planning and manipulation…The wrong choice could lead to litigation, and the right choice can save you lakhs legally.

This is what 95% consultants do when you ask them to do your tax-planning.

Here is why I’m so sure:

- They don’t have enough knowledge about the right way of tax planning. They’re jack of all trades, but master of none.

- Even if they have enough knowledge, they don’t have the right expertise.

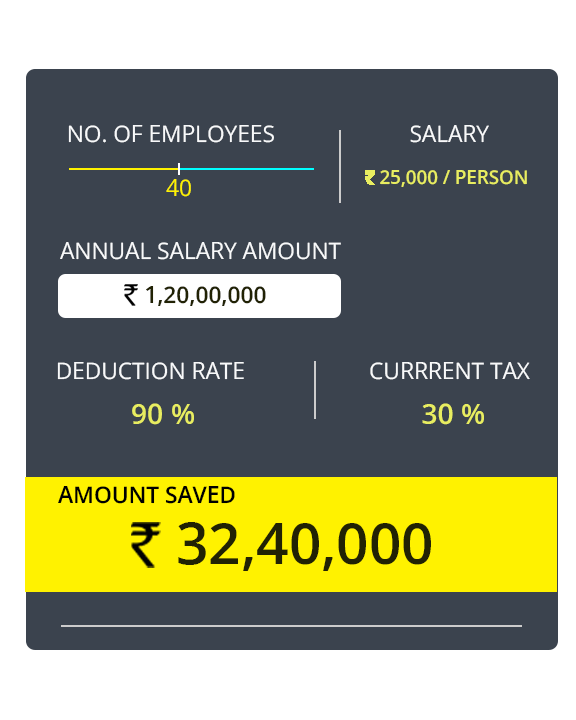

If you are a manufacturer who has employees with a salary of less than Rs. 25,000 or more than Rs. 2 crore, I can actually help you save 8-10% on your effective tax rate!

Here’s HOW!

CUSTOMER REVIEWS

Don’t Trust My Words? Trust the Results.

This Webinar Will Help Manufacturers

- ✅ Double your tax savings on salaries paid to employees earning less than Rs. 25,000 per month.

- ✅ Get your blocked income tax refunds from the Income Tax Department.

- ✅ Discover enhanced tax deduction strategies for ESOPs.

- ✅ Boost take-home earnings for promoters.

- ✅ Learn about how to manage your company’s finances, including cash flow, taxation, and budgeting.

That’s Not All; You Will Also Be Getting These BONUSES For Free!

Bonus #1

Get Access To Our Exclusive Whatsapp Group

-

You can connect with like-minded people

-

Clear your doubts anytime.

-

Get insights on market trends and regulatory updates relevant to manufacturers.

Bonus #2

Tax-Saving Toolkit

-

Toolkit with templates, guides, and resources related to tax savings for manufacturers.

-

Tax deduction cheatsheet.

-

Tips to manage your company’s finances, including cash flow and budgeting that your Tax Consultants aren’t telling you.

Tax Consultant Dipanshu Mutreja

Expert of Tax Planning

He began his career as a Deputy Manager in Deloitte, where he developed a deep understanding of the Indian and international tax landscape.

Here is what he has achieved over the course of his career:

- Tax savings worth INR 100+ crore for MNCs including listed companies.

- International tax planning for reputed brands in India and the Middle East.

- Corporate tax compliance for over 40 MNC clients.

- Obtained lower deduction certificates for transactions worth INR 2000+ crore in under 40 days.

- Tax-efficient cash repatriation for an Indian subsidiary of a US multinational company.

- Curated a pitch for ex-CFO of a global waste management company for raising equity of USD 4 million.

My Clients

Worked With

High Profile Clients

Frequently Asked Questions.

01 What is this webinar about?

This webinar is designed to help manufacturers understand how they can legally save taxes without fear of litigation. The insights and strategies covered will help you optimize your tax planning, ensuring compliance while maximizing your tax savings.

02 Who is this webinar for?

This webinar is specifically designed for emerging or hotshot manufacturers with employees in the salary range of less than Rs. 25,000 and more than Rs. 2 crore for Saving taxes Smooth litigation, if any Expansion without loans More take-home for promoters

03 I’m already working with an accountant. How can this webinar benefit me?

Working with an accountant is valuable, and this webinar can complement their expertise. The knowledge you’ll gain after attending this webinar will enable you to make more informed decisions with your Tax Consultant and ensure you're maximizing your tax savings to the fullest.

04 Are these tax-saving strategies compliant with the law?

Of course! The tax-saving strategies discussed in the webinar are fully within the legal framework and won’t lead to litigation.

05 Can I ask questions?

Definitely! There will be a dedicated Q&A session where you can ask any questions related to the topic that trouble you.

06 Is there a fee to attend the webinar?

No, there is a no registration fee to attend the webinar.